philadelphia property tax rate calculator

For comparison the median home value in Philadelphia County is. 160000 Median Household Income.

City Releases Property Tax Calculator To Assist Homeowners Department Of Revenue City Of Philadelphia

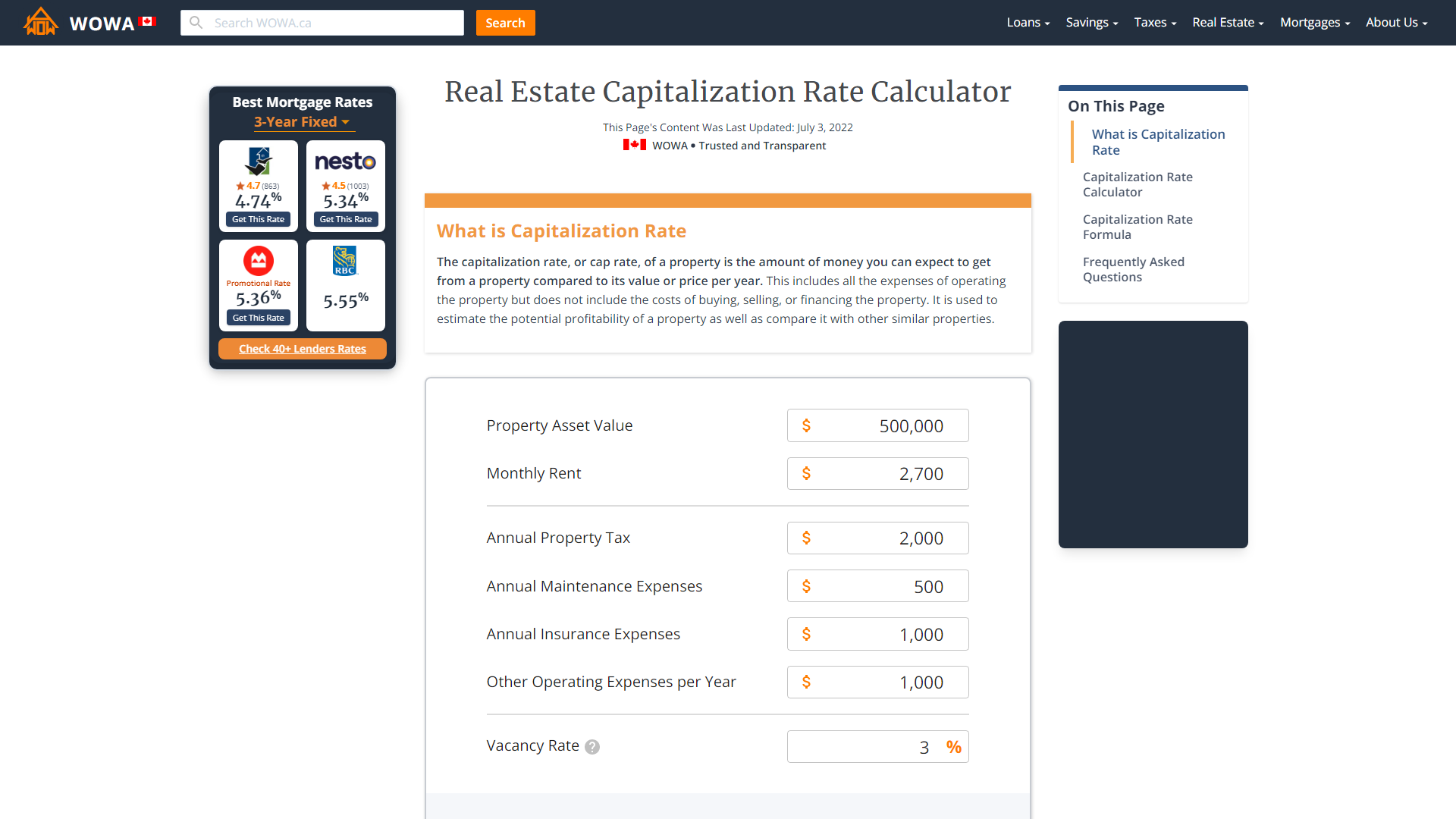

For the 2022 tax year the rates are.

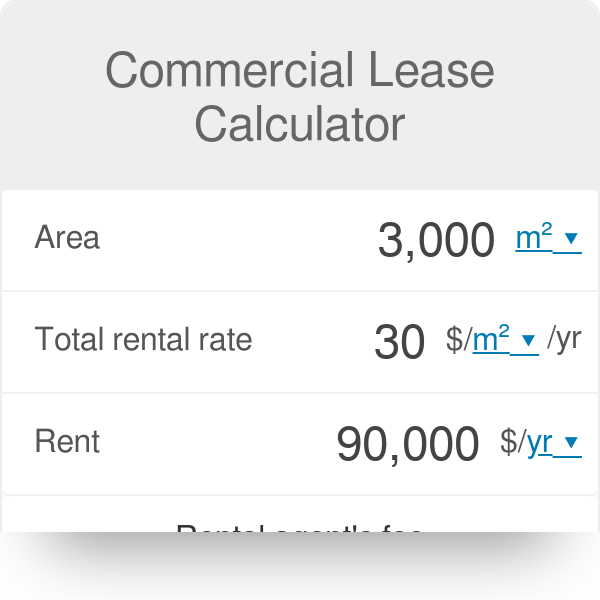

. To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price. Based on latest data from the US Census Bureau. 06317 City 07681 School.

Use the Property App to get information about a propertys ownership sales history value and physical characteristics. Philadelphia County Property Taxes Range. Current County Assessed Value Select a.

Search and Pay your Real Estate Taxes. Taxation of properties must. Ad Enter Any Address Receive a Comprehensive Property Report.

See Results in Minutes. Philadelphia County Property Taxes. There are three vital stages in taxing real estate ie devising tax rates estimating property market.

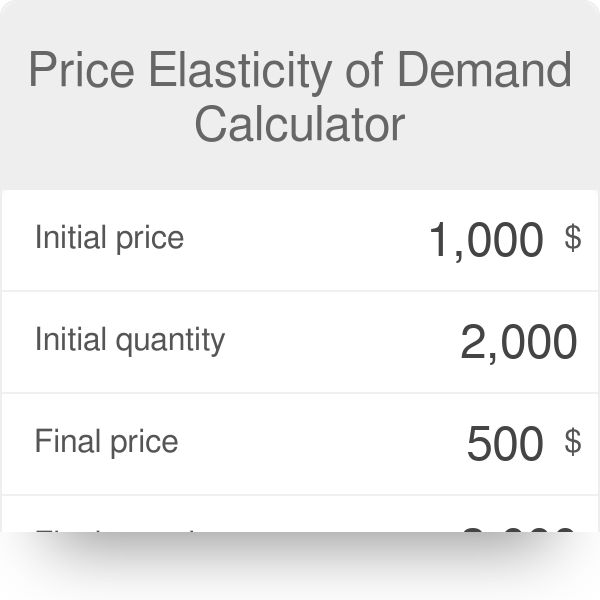

Pennsylvania Property Tax. PHILADELPHIA City officials today unveiled a web-based calculator that will allow property owners to see how changes in assessments and the Mayors Fiscal Year 2019. The average effective property tax rate in Pennsylvania is 150 but that varies greatly depending on where you live.

2496 Median Home Value. Then receipts are distributed to these taxing authorities according to a predetermined plan. Pittsburgh Property Tax Median Annual Property Tax.

Tax rate for nonresidents who work in Philadelphia Residents of Philadelphia pay a flat city income tax of 393 on earned income in addition to the Pennsylvania income tax and the. The City of Philadelphia and the School District of Philadelphia both impose a tax on all real estate in the City. Philadelphia County Pike County Schuylkill County Snyder County Somerset County.

1 be equal and uniform 2 be based on current market value 3 have one appraised value and 4 be deemed taxable unless specially exempted. TAX RATE MILLS ASSESSMENT. In Philadelphia County for.

You can also generate address listings near a. To estimate yearly taxes select a County enter an assessed value and select a municipality. The average Philadelphia property tax rate is 149.

It is a free tax calculator provided by the Affinity Real Estate Team for estimation purposes only. This page is not an official county page. The Actual Value Initiative or AVI is a program for re-evaluating all properties in the city.

Use the property tax calculator to estimate your real estate taxes. Average Property Tax Rate in Philadelphia County. Start filing your tax return now.

Discover the Registered Owner Estimated Land Value Mortgage Information. You can use this application to estimate your real estate tax under the Actual Value Initiative AVI.

Living Off Validator Income A Calculator R Ethstaker

Archeage Tax Certificate Calculator R Archeage

How Much House Can I Afford Bhhs Fox Roach

Property Tax How To Calculate Local Considerations

A Capital Gains And Tax Calculator For Your Stock Crypto Investments R Personalfinancecanada

Maintenance Technician Resume Example Template Vibes Manager Resume Resume Examples Job Resume Examples

Philly Released 2023 Property Assessments Here S How To Calculate Your Property Tax Venture Philly Group

Cap Rate Calculator Formula And Faq 2022 Wowa Ca

Pennsylvania Property Tax Calculator Smartasset

Estimate Your 2023 Property Tax Today Department Of Revenue City Of Philadelphia

Philly Released 2023 Property Assessments Here S How To Calculate Your Property Tax Venture Philly Group

Transfer Tax Calculator 2022 For All 50 States

Philly Announces New Tax Rates For Wage Earnings And Other Taxes Department Of Revenue City Of Philadelphia